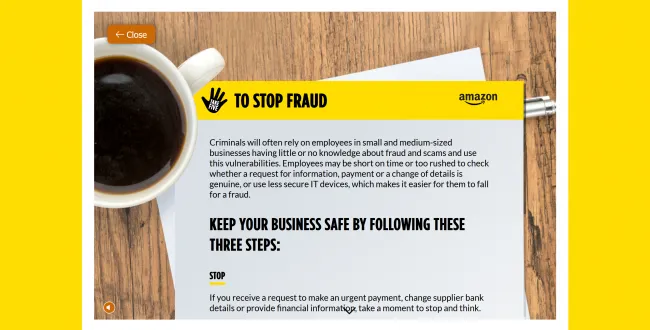

We work with UK Finance on their Take Five To Stop Fraud initiative, which seeks to change behavior's around fraud in consumer and business audiences in the UK.

We provide Take Five with expert consultancy and hands-on delivery around important campaigns, and our client particularly appreciates our effort to come up with creative ways to deliver this behavior change via online channels.

The latest example of this is our 'Can you spot the fraud? interactive, co-funded by Amazon, designed to shake SME staff out of their complacency and set them a challenge to get through three days as an employee of Fine Widgets Ltd without running afoul of fraud.

Taking a quirky humor and engaging tone saw extremely high user participation, with a quarter of all players giving us more than 5 minutes of uninterrupted attention, and seeing an average of 2.2 minutes across all visits - a total of 3,000 hours of attention paid by our target audience to fraud messaging to date.

Our work even caught the attention of the BIMA (British Interactive Media Association) judges, winning a coveted BIMA Award for best use of digital in a B2B context.

The issue

Fraud costs small businesses millions each year, and yet for most it’s far from an active concern. It should be. More than 80% of small business

owners in the UK report receiving potentially fraudulent emails and texts. But only half say they take the time to regularly stop and consider them before acting.

UK Finance, the trade association for the UK’s banking and finance sector, has seen huge success via its long-running Take Five to Stop Fraud campaign in increasing awareness of and action on fraud among consumer audiences. And for International Fraud Awareness Week 2022 they wanted a piece of online content that would target SMEs and lead to real behaviour change.

Previous consumer campaigns had used a simple ‘how scam savvy are you’ quiz which challenged people to spot fraudulent emails. But this approach would not work for SME audiences. In a work context people at all levels of companies were less likely to see fraud as an issue that directly affected them, and crucially though they might consider themselves savvy at spotting personal fraud, most had very little awareness of common types of fraud that affect businesses.

The idea

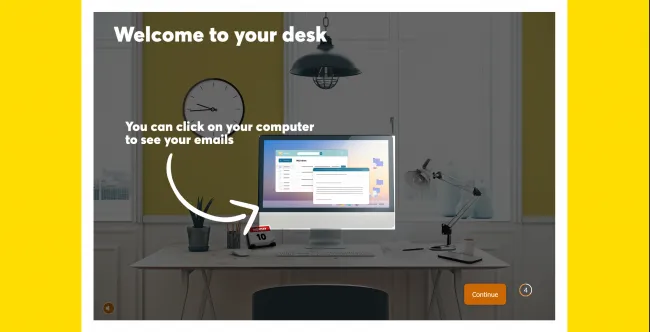

Our solution was to develop the idea of an online quiz into something with higher salience for commercial audiences, and which positioned messaging within the appropriate context - a desk-based interactive taking users through three days in the life of an employee at a widget

company.

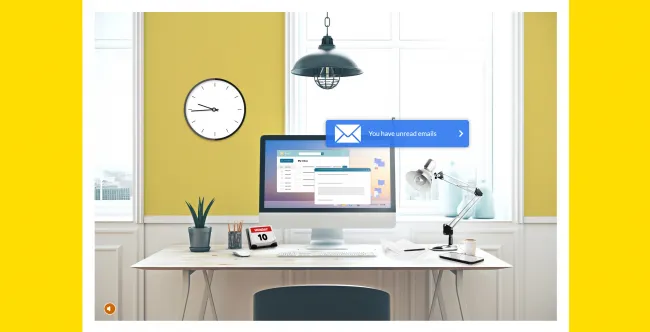

This experience, modelled on the ‘in tray’ exercises used in employment assessment centres, put users in the role of answering emails, taking phone calls and making decisions in a live work environment, with design mimicking a working setup. To keep users engaged, we heightened reality through humour, sharp writing and little ‘easter egg’ surprises within the design.

Examples of the latter included desk lights you could toggle on and off, hyperbolic sound effects for interactions and the use of quirky images and

memes in various scenarios (you’ll have to go through the experience yourself to see what we mean!)

Crucially, this design concept allowed us to embed information and learnings throughout the experience in a way that feels relevant to the user at each stage, embedding important concepts firmly in the actions just taken by the user rather than letting them.

How we did it

In early discussions we decided it was important to stress the everyday channels through which you might be a target for fraud. In order to capture

this in our desk-based activity we devised a list of interactions that the user would be taken through and that we could mix and match to tell a bigger

story. These included incoming emails, phonecalls text messages and even a discussion with a colleague over a tea break.

This set of interactions allowed us to build a sort of game engine driven by a simple script, recording people’s responses to each scenario and then pushing the story forward based on those decisions. Using this scripted method meant we were able to prototype quickly (initially in Twine), change

the sequence of events and add in new ones based on client feedback and user testing. The StoryStitcher system we developed is something we’re

carrying forward into our future narrative development work.

The final product was also packaged into an embedabble app that could be easily included in partner websites so that the campaign could increase its reach and bring in new audiences.

Impact

The experience was built as a series of incremental challenges, so that important points were made in the first day and then repeated with variations and additional contexts in the second and third day, on the assumption that the majority of those who started would not finish. As a 5-10 minute interactive experience in total, around an admittedly offputting topic, our expectations were of a completion rate of around 5%.

In fact, 32% of all those who started the experience finished it, with an average engagement time of 2.6 minutes across all users.

That equates to more than 196,000 minutes (or 136 days) of attention - that’s 136 days worth of users looking at and engaging with topics around SME fraud, an astounding result giving an ‘attention ROI’ of 320 seconds per £1 spent. And as the experience is deliberately free of time or location contexts, it’s a return that will increase as it’s used across other markets and throughout the lifetime of the wider campaign.

Will you take the challenge?

Find out if you are scam-savvy and experience it for yourself.